As we usher in a new year, it’s time to revamp our living spaces with fresh hues and trends that reflect the spirit of the times. The year 2024 brings with it an exciting palette of colours that embody a sense of optimism, innovation, and sustainability. From soothing earth tones to bold statement shades, let’s delve into the captivating world of paint trends for 2024.

- 1. Natural Neutrals: In an era where reconnecting with nature is paramount, natural neutrals dominate the paint scene. Shades inspired by earthy elements like stone, clay, and sand create a serene backdrop for any room. Think warm beiges, soft grays, and muted greens that evoke a sense of tranquility and balance.

- 2. Oceanic Blues: As we strive to protect our planet’s precious oceans, it’s no surprise that oceanic blues are making waves in interior design. From deep navy to tranquil azure, these shades bring a sense of depth and serenity to any space. Pair them with crisp whites and natural textures for a coastal-inspired look that’s both timeless and refreshing.

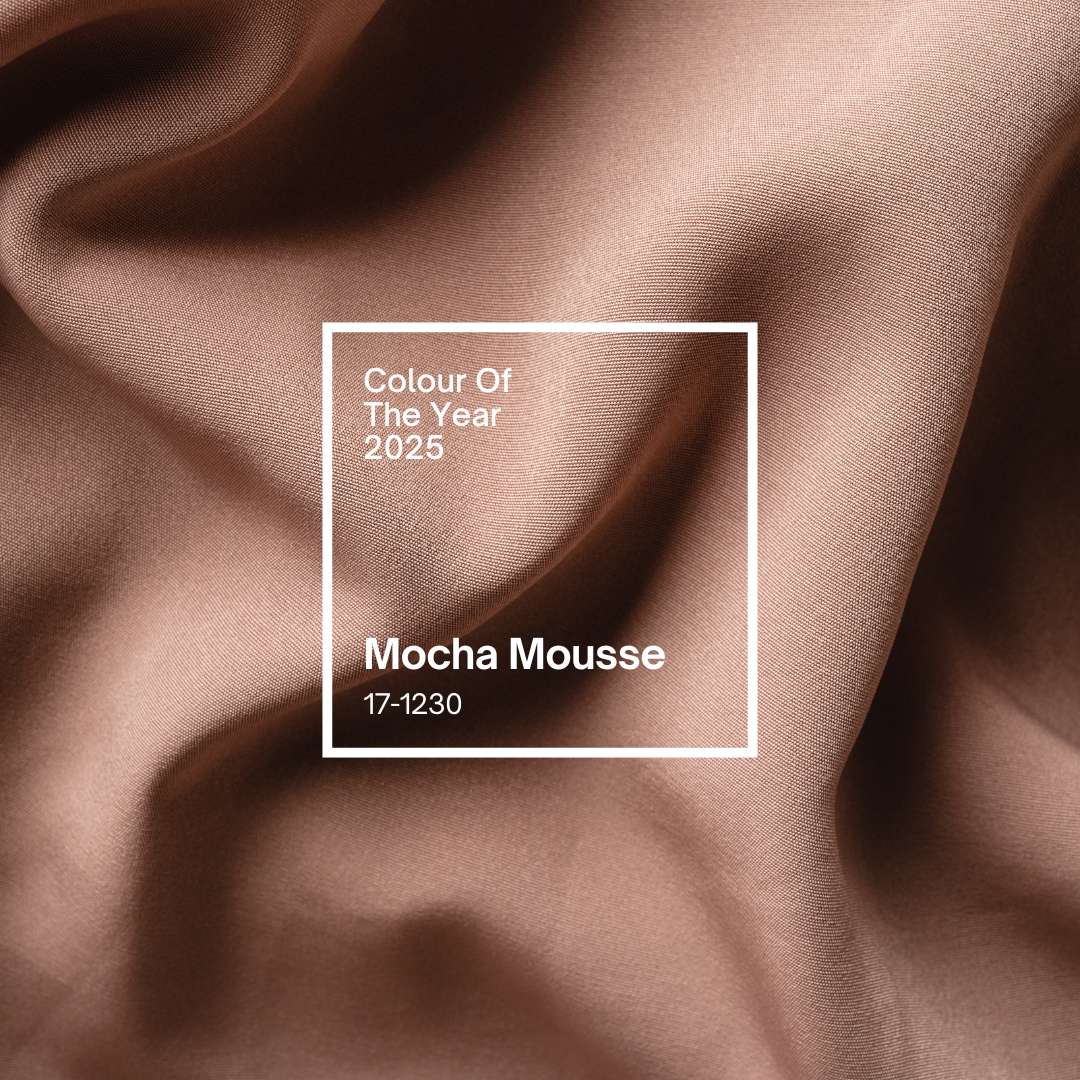

- 3. Sustainable Shades: With sustainability at the forefront of design trends, eco-friendly paint options are gaining popularity. From zero-VOC formulas to paint made from recycled materials, homeowners are embracing paints that are gentle on the environment and on their health. Look out for shades inspired by nature’s palette, such as leafy greens, warm terracottas, and earthy browns.

- 4. Bold Statements: For those who crave a pop of color, bold statement shades are the way to go. Vibrant hues like emerald green, fiery red, and electric blue inject energy and personality into any room. Whether used as an accent wall or on furniture pieces, these daring colours add a sense of drama and flair to your space.

- 5. Soft Pastels: Soft pastels continue to reign supreme in 2024, offering a delicate and dreamy aesthetic. From blush pink to powder blue, these gentle hues create a sense of warmth and intimacy in any room. Use them to create a calming retreat in your bedroom or to add a touch of sweetness to your kitchen.

- 6. Global Influences: In a world that’s more connected than ever, global influences are shaping design trends in exciting ways. From Moroccan-inspired motifs to Japanese minimalist aesthetics, cultural elements are finding their way into paint choices. Rich jewel tones, intricate patterns, and textured finishes bring a sense of wanderlust and sophistication to your home.

- 7. Metallic Accents: Metallic accents add a touch of glamour and sophistication to any space. Whether it’s gold, silver, or copper, these shimmering hues create a sense of luxury and opulence. Use metallic paints to highlight architectural details, furniture pieces, or accessories for a modern and elegant look.

In conclusion, the paint trends of 2024 offer a diverse array of colours and styles to suit every taste and preference. Whether you prefer the soothing simplicity of natural neutrals or the boldness of statement shades, there’s something for everyone in this year’s palette. So, embrace the colors of tomorrow and transform your living space into a reflection of your personal style and the spirit of the times.